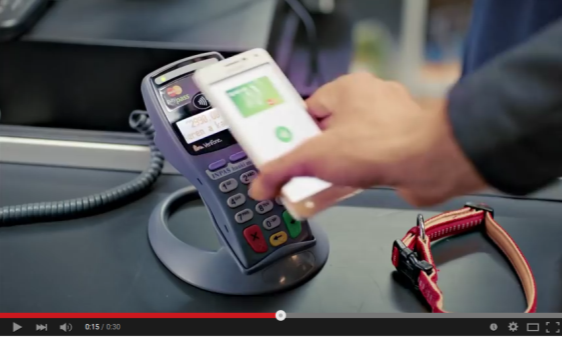

Many people might have already heard about Apple pay, NFC, HCE solutions, technologies that are said to “change our paying habits right in the moment of their launch”. Here are the most different mobile payment solutions and nothing has changed. On the surface. Everything goes as yesterday did: we got out the bank card or the cash from our wallet and paid for the coffee. On the surface. Not the youngsters of today, generations Y and Z! It is no coincidence that OTP, Vodafone and MasterCard unequivocally address them in their new campaign inviting them to mobile payment.

Many people might have already heard about Apple pay, NFC, HCE solutions, technologies that are said to “change our paying habits right in the moment of their launch”. Here are the most different mobile payment solutions and nothing has changed. On the surface. Everything goes as yesterday did: we got out the bank card or the cash from our wallet and paid for the coffee. On the surface. Not the youngsters of today, generations Y and Z! It is no coincidence that OTP, Vodafone and MasterCard unequivocally address them in their new campaign inviting them to mobile payment.

There are some revolutionary changes, that’s spreading is somehow not obvious for every target group. According to a research of IMD Business School in 2013, there is a reason for it. The reason is that the developments did not focus on what they should have had to. They put all mobile users forward. Of course they are a big mass but it was not taken into consideration that exactly THEY are the most satisfied users in the whole payment process. It simply does not matter to them whether they use their cards or their mobiles whilst paying. In point of costs everybody knows that payment is free of charge. It was simply thought about people in all age-groups that they will yield under pressure, although not all people are “geeks” who desire to use every new technology straightaway. We can say that average people are rational who have to be persuaded.

However the analysis of JWTintelligence titled The Future of Payments & Currency unequivocally proves that members of 18-34 age group drastically (!) differently use mobiles and computers. They are more open to mobile payment and use of new technologies; Bitcoin and other electronic money are not strange for them. They simply live and think differently compared to elder people.

However the analysis of JWTintelligence titled The Future of Payments & Currency unequivocally proves that members of 18-34 age group drastically (!) differently use mobiles and computers. They are more open to mobile payment and use of new technologies; Bitcoin and other electronic money are not strange for them. They simply live and think differently compared to elder people.

The industry survey showed that almost nobody is sure in development. In the question, who will be the winner of the future due to changes, every industrial role player got equal number of votes. Probably a secondary function will be played by technologies in the future. It is indifferent for the targeted young people, how their banking cards get into their mobile phones: by Host Card Emulation (HCE) or SIM based UICC through TSM.

From the point of view of business model, it is not indifferent what technologies are chosen by the companies, as the contact between the companies and their clients depend on the technologies. Current competition against brands is about closed relationship with generation Y and Z, as they will be the mass with earning capacity and influence on consumption.

It is not incidental for smaller technological companies what is the situation in the larger ones’ battles, but their own business model is much simpler. We will be prepared to all technological solutions in the future in the field of mobile payment in order to make the choice of our clients easy. Whilst we are waiting for the big boom of this market, our TSM service for SIM card based solution, that is already (!) qualified by MasterCard and has proved in the Hungarian Mobile Wallet (Mobiltárca) pilot and our TSP (Token Service Provider) service for Host Card Emulation technology that is under development will be ready and operate securely soon.

Complicated abbreviations and lingo get slowly into background, as our message will be simple: “we are able to personalise domestic or foreign, PVC or mobile banking cards in all ways.” It is not a question, who will be the winner!